Essay

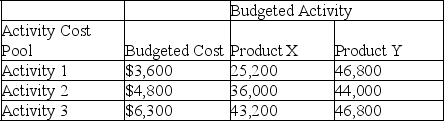

A company has two products: X and Y.It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools.

Annual production and sales level of Product X is 161,100 units,and the annual production and sales level of Product Y is 275,200 units.

Annual production and sales level of Product X is 161,100 units,and the annual production and sales level of Product Y is 275,200 units.

a.Compute the approximate overhead cost per unit of Product X under activity-based costing.

b.Compute the approximate overhead cost per unit of Product Y under activity-based costing.

Correct Answer:

Verified

Correct Answer:

Verified

Q115: Explain some of the disadvantages of the

Q116: Facility-level costs are not traceable to individual

Q117: ABC assumes all costs in a _

Q118: The usefulness of overhead allocations based on

Q119: Red Raider Company uses a plantwide overhead

Q121: Overhead costs are often affected by many

Q122: Red Raider Company uses a plantwide overhead

Q123: Base Runner,Inc.manufactures baseball bats that go through

Q124: Overhead costs cannot be _ in the

Q125: Overhead costs are indirect costs so assigning