Essay

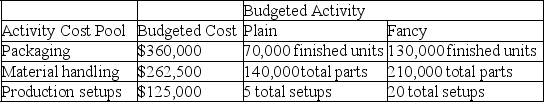

Sparks Company produces and distributes two types of garden sculptures,Plain and Fancy.Budgeted cost and activity for each of its three activity cost pools are shown below.The company plans to produce and sell 64,000 plain units and 49,150 fancy units.

a.Compute the approximate overhead cost per unit of Plain under activity-based costing.

a.Compute the approximate overhead cost per unit of Plain under activity-based costing.

b.Compute the approximate overhead cost per unit of Fancy under activity-based costing.

Correct Answer:

Verified

Correct Answer:

Verified

Q43: The cost object(s)of the activity-based costing method

Q44: When calculating the departmental overhead rate,the numerator

Q45: What is the reason for pooling costs?<br>A)To

Q46: Allocated overhead _ vary depending upon the

Q47: The plantwide overhead rate is determined using

Q49: Activity-based costing often shifts overhead costs from

Q50: Aztec Industries produces bread which goes through

Q51: Cleveland Choppers manufactures two types of motorcycles,a

Q52: Lake Erie Company uses a plantwide overhead

Q53: A company has two products: A and