Essay

Drop Anchor takes special orders to manufacture sail boats for high-end customers.Prepare journal entries to record the transactions below and prepare job cost sheets for September.

a.Purchased raw materials on credit,$145,000.

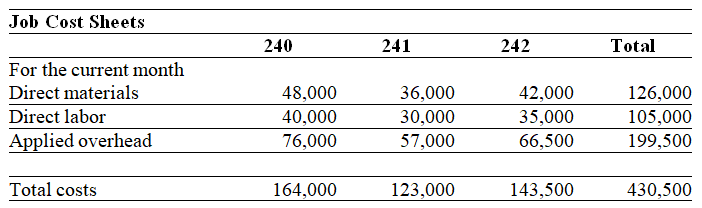

b.Materials requisitions: Job 240,$48,000; Job 241,$36,000; Job 242,$42,000; indirect materials were $12,000.

c.Time tickets used to charge labor to jobs: Job 240,$40,000; Job 241,$30,000; Job 242,$35,000,indirect labor is $25,000.

d.The company incurred the following additional overhead costs: depreciation of factory building,$70,000; depreciation of factory equipment,$60,000; expired factory insurance,$10,000; utilities and maintenance cost of $20,000 were paid in cash.

e.Applied overhead to all three jobs.The predetermined overhead rate is 190% of direct labor cost.

f.Transferred jobs 240 and 242 to Finished Goods Inventory.

g.Sold job 240 for $300,000 for cash.

h.Closed the under- or over-applied overhead account balance.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Underapplied overhead is the amount by which

Q194: The job cost sheet for Job number

Q194: The cost of all direct materials issued

Q195: Period costs for a manufacturing company,such as

Q196: How do manufacturing firms adjust the overapplied

Q197: Morris Company applies overhead based on direct

Q198: A time ticket is a source document

Q200: The job order cost sheets used by

Q201: Job order costing would be appropriate for

Q203: Clemmens Company applies overhead based on direct