Essay

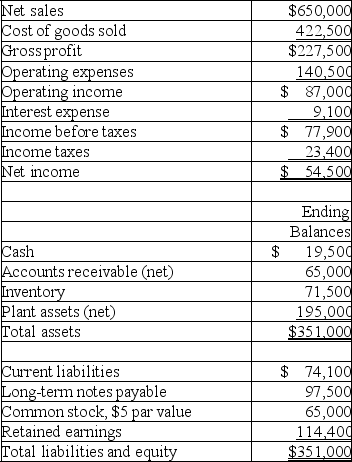

A company's calendar-year financial data are shown below.The company had total assets of $339,000 and total equity of $144,400 for the prior year.No additional shares of common stock were issued during the year.The December 31 market price per share is $49.50.Cash dividends of $19,500 were paid during the year.Calculate the following ratios for the company:

(a)profit margin ratio

(b)gross margin ratio

(c)return on total assets

(d)return on common stockholders' equity

(e)book value per common share

(f)basic earnings per share

(g)price earnings ratio

(h)dividend yield.

Correct Answer:

Verified

Correct Answer:

Verified

Q80: Capital structure measures a company's ability to

Q83: Guidelines (rules-of-thumb)are general standards of comparison developed

Q84: Use the following information from the current

Q85: Working capital is computed as current liabilities

Q86: Jones Corp.reported current assets of $193,000,current liabilities

Q87: An example of an intracompany comparison is

Q88: A corporation reports the following year-end balance

Q89: Martinez Corporation reported net sales of $765,000,net

Q90: Industry standards for financial statement analysis:<br>A)Are based

Q158: Net income divided by average total assets