Essay

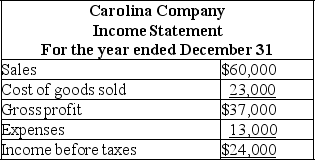

Carolina Company uses the perpetual LIFO method for valuing its ending inventory.The following financial statement information is available for its first year of operation:

Carolina's ending inventory using the perpetual LIFO method was $8,700.Carolina's accountant determined that had the company used perpetual FIFO,the ending inventory would have been $9,100.

Carolina's ending inventory using the perpetual LIFO method was $8,700.Carolina's accountant determined that had the company used perpetual FIFO,the ending inventory would have been $9,100.

a.Determine what the income before taxes would have been,had Carolina used the FIFO method of inventory valuation instead of LIFO.

b.What would be the difference in income taxes between LIFO and FIFO,assuming a 30% tax rate?

c.If Carolina wanted to lower the amount of income taxes to be paid,which method would it choose?

Correct Answer:

Verified

a.If ending inventory is $400 higher usi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: An advantage of FIFO is that it

Q94: A company has beginning inventory of 15

Q110: When costs to purchase inventory regularly decline,which

Q114: Explain how the inventory turnover ratio and

Q168: On March 31 a company needed to

Q188: Overstating beginning inventory will understate cost of

Q213: Explain how the lower of cost or

Q216: Salmone Company reported the following purchases and

Q217: The LIFO conformity rule:<br>A)Requires when LIFO is

Q219: A company reported the following data:<br> <img