Essay

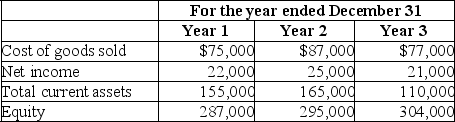

The Community Store reported the following amounts on their financial statements for Year 1,Year 2,and Year 3:

It was discovered early in Year 4 that the ending inventory on December 31,Year 1 was overstated by $6,000,and the ending inventory on December 31,Year 2 was understated by $2,500.The ending inventory on December 31,Year 3 was correct.Ignoring income taxes determine the correct amounts of cost of goods sold,net income,total current assets,and equity for each of the years Year 1,Year 2,and Year 3.

It was discovered early in Year 4 that the ending inventory on December 31,Year 1 was overstated by $6,000,and the ending inventory on December 31,Year 2 was understated by $2,500.The ending inventory on December 31,Year 3 was correct.Ignoring income taxes determine the correct amounts of cost of goods sold,net income,total current assets,and equity for each of the years Year 1,Year 2,and Year 3.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: The simple rule for inventory turnover is

Q23: The _ method of assigning costs to

Q48: In applying the lower of cost or

Q64: Consignment goods are:<br>A)Goods shipped by the owner

Q72: The choice of an inventory valuation method

Q78: Understating ending inventory understates both current and

Q83: Generally accepted accounting principles require that the

Q86: Costs included in the Merchandise Inventory account

Q86: Calculate the ending inventory using FIFO for

Q97: The assignment of costs to cost of