Short Answer

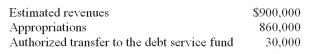

The Charleston city council approved and adopted its budget for FY 2011.The budget for the General Fund contained the following amounts:  When the General Fund budget for FY 2011 is recorded,indicate whether each of the following accounts should be debited (D),credited (C),or is not affected (N).

When the General Fund budget for FY 2011 is recorded,indicate whether each of the following accounts should be debited (D),credited (C),or is not affected (N).

_____ 1.Estimated revenues

_____ 2.Budgetary Fund balance

_____ 3.Appropriations

_____ 4.Estimated other financing uses

_____ 5.Expenditures

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Program revenues are distinguished from general revenues

Q10: Define the term revenue and distinguish between

Q19: The City of Charleston recorded its FY

Q21: Extraordinary items and special items are reported<br>A)

Q22: The revenue classifications recommended by GASB standards

Q25: The expenditure classification "Public Safety" is an

Q34: The County Commission of Benton County adopted

Q59: Government-wide financial statements include financial information presented

Q60: The account "Interfund Transfers In" would be

Q73: Under the modified accrual basis of accounting