Essay

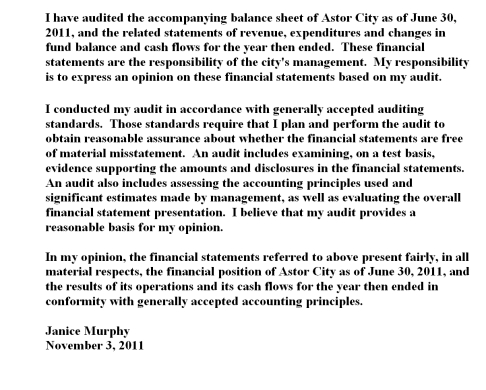

Astor City,a small city that is not required to have independent audit,voluntarily decided to have an audit of its financial records.Currently,the city generates $900,000 in revenues.Of the revenue generated,10% is from state sources and 2% is from federal sources.Janice Murphy,a CPA who serves on the city council has orally agreed to conduct the audit for a small gratuitous fee.Murphy decided not to accept a full fee since in the last three years she has gotten away from doing audit work and has concentrated her time on tax preparation and small business consulting.Murphy conducts the audit and presents the city with the following audit report:  Required

Required

(a)At a minimum what audit standards apply to Astor City (GAAS,GAS or Single Audit Act)? Why?

(b)Discuss any potential violations of the applicable audit standards.

Correct Answer:

Verified

(a)Two percent of $900,000 is only $18,0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: In the auditor's report the financial statements

Q15: Only state and local governments and their

Q23: Attestation engagements include<br>A) Assessment of the extent

Q31: All of the following reports are included

Q36: Performance audits,as defined in the GAO's Governmental

Q37: The yellow book (i.e.,GAGAS)independence standard prescribes two

Q39: What are the essential elements of an

Q43: Which of the following is one of

Q47: The scope paragraph of an independent auditor's

Q54: In which paragraph of the standard audit