The Accounting Records for Dusek Dentistry,Inc

2 Deposits of $2,100 from February 26-28 Are in Transit

Essay

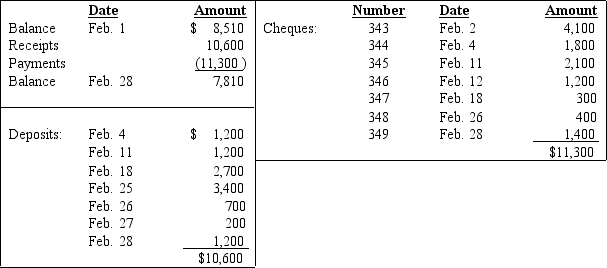

The accounting records for Dusek Dentistry,Inc.show the following information for February 28,Year 1:

Additional information pertaining to this chequing account was obtained by comparing the monthly bank statement with the company's records.The following was revealed:

1. The ending cash balance per the bank statement was .

2. Deposits of $2,100 from February 26-28 are in transit.

3. Cheques #347 and #349 are autstanding.

4. A 100 NSF cheque fram a customer did not clear the bank. This NSF cheque was included in the February 25th deposit.

5. Cheque #343 was prepared correctly as a $1,400 payment an account. This cheque was properly recorded by the bank but was erraneausly included an the company's records in the amount of $4,100.

6. A debit meno for $2,000 was shown on the bank statement as notice that the company's rent was autonatically paid from the chequing account an February lst.

7. A credit memo for was shown an the bank statement as notice that the company had earned interest an its average daily balance in this chequing account.

8. The bank's fees for the month totalled .

A)Prepare a bank reconciliation to calculate the company's adjusted cash balance at February 28,Year 1.

B)Prepare the journal entries that must be recorded to adjust the cash records as a result of these bank reconciliation procedures.

Correct Answer:

Verified

A)

_TB550...

_TB550...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q91: The following set of items describes activities

Q129: For which of the following is the

Q130: On a bank reconciliation, interest earned for

Q133: A cheque written by a company but

Q135: Choose the proper category of internal control

Q137: When a bank reconciliation is being prepared,which

Q139: As part of a sound system of

Q142: The best response to an employee caught

Q149: An internal control activity that separates responsibilities

Q164: Explain some internal control procedures that a