Essay

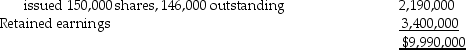

Cough FX Limited reports the following shareholders' equity as of December 31,2017:

Preferred shares,$5.00,authorized 100,000 shares,

Common shares,authorized 200,000 shares,

Common shares,authorized 200,000 shares,

Determine the following:

Determine the following:

a.What was the average issue price per common share?

b.What was the average issue price per preferred share?

c.Assume the board of directors declares dividends totaling $1,850,000 to the shareholders.The preferred shares are cumulative,and no dividends were declared last year.Calculate the amount per share each class of shares will receive.

d.Assume the board of directors authorizes a 2-for-1 split on the common shares.Calculate the number of shares outstanding after the split and the book value of Both classes of shares.

e.Assume the board of directors authorizes a 15% stock dividend on the common shares after the stock split.The current selling price of the common shares is $9.Prepare the journal entry to distribute the stock dividend.

Correct Answer:

Verified

a.($2,190,000)/ 146,000 = $15

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q53: The book value of a share is

Q54: Explain the fundamental difference between retained earnings

Q55: Pharmaprix Corporation's balance sheet reported the following

Q56: Before a company can pay dividends to

Q57: JetNew issued 50,000 common shares on January

Q59: Describe the rights typically enjoyed by common

Q60: Name several accounts that would appear in

Q62: Share capital is also known as:<br>A) contributed

Q63: The issuance of preferred shares requires a:<br>A)

Q66: When shares are issued in exchange for