Essay

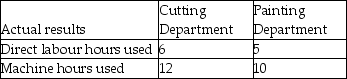

The Highland Corporation uses departmental overhead rates to allocate its manufacturing overhead to jobs.The company has two departments-cutting and painting.The Cutting Department uses a departmental overhead rate of $15 per machine hour,while the Painting Department uses a departmental overhead rate of $9 per direct labour hour.Job 586 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 586 is $900.

Required: What was the total cost of Job 586 if the Highland Corporation used the departmental overhead rates to allocate manufacturing overhead?

Correct Answer:

Verified

_TB1765_00_TB1765_00...

_TB1765_00_TB1765_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Companies that use departmental overhead rates trace

Q77: If a company's plantwide overhead rate is

Q79: The benefits of using the ABC costing

Q120: Credit Valley Products manufactures its products in

Q122: Sparrow Manufacturing manufactures small parts and uses

Q123: Rhapsody Corporation manufactures several different products and

Q126: Hinckley & Granger Company had the following

Q127: Hinckley & Granger Company had the following

Q129: Green Bags Company manufactures cloth grocery bags

Q130: Bond Industries uses departmental overhead rates to