Essay

Speedy Machine Products manufactures its products in two separate departments,Machining and

Painting.Total manufacturing overhead costs for the year are budgeted at $2,500,000.Of this amount the Machining Department incurs $1,500,000 (primarily for machine operation and depreciation)while the Painting Department incurs $1,000,000.Speedy Machine Products estimates that it will incur 12,000 machines hours (all in the Milling Department)and 40,000 direct labour hours (15,000 in the Milling Department and 25,000 in the Assembly Department)during the year.

Speedy Machine Products currently uses a plant-wide overhead rate based on direct labour hours

to allocate overhead.However,the company is considering refining its overhead allocation

system by using departmental overhead rates.The Machining Department would allocate its

overhead using machine hours (MH),but the Painting Department would allocate its

overhead using direct labour (DL)hours.

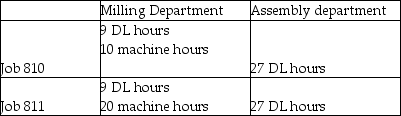

The following chart shows the machine hours (MH)and direct labour (DL)hours incurred

by Jobs 810 and 811 in each production department:

Both Jobs 810 and 811 used $7,500 of direct materials.Wages and benefits total $30 per direct labour hour.Speedy Machine Products prices its products at 120% of total manufacturing costs.

Required:

1.Compute Speedy Machine Products' current plant-wide overhead rate.

2.Compute refined departmental overhead rates.

3.Compute the total amount of overhead allocated to each job if Speedy Machine Products uses its current plant-wide overhead rate.

4.Compute the total amount of overhead allocated to each job if Speedy Machine Products uses departmental overhead rates.

5.Do both allocation systems accurately reflect the resources that each job used? Explain.

6.Compute the total manufacturing cost and sales price of each job using Speedy Machine Products' current plant-wide overhead rate.

7.Compute the total manufacturing cost and sales price of each job using Speedy Machine Products' refined departmental overhead rates

8.Based on the current (plant-wide)allocation system,how much profit did Speedy Machine Products think it earned on each job?

9.Based on the departmental overhead rates and the sales price determined in Requirement 7,how much profit did it really earn on each job?

Correct Answer:

Verified

1.Plant-wide overhead rate = $2,500,000/...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: What is the last step in developing

Q51: Vittoria Corporation manufactures two products-Carts and Wheelbarrows.The

Q53: Traditions Home Accessories Company manufactures pillows using

Q54: Electronics Unlimited uses activity-based costing to allocate

Q57: Electronics Unlimited uses activity-based costing to allocate

Q58: Louis Corporation,which uses an activity-based costing system,produces

Q64: Machine set-up would most likely be classified

Q108: Managers often reap benefits by using ABC

Q136: Research and development would most likely be

Q143: Value-added activities are<br>A) also called waste activities.<br>B)