Essay

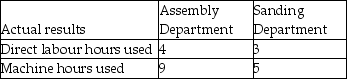

Babcock Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs.The company has two departments: Assembly and Sanding.The Assembly Department uses a departmental overhead rate of $20 per machine hour,while the Sanding Department uses a departmental overhead rate of $15 per direct labour hour.Job 396 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 396 is $1,200.

What was the total cost of Job 396 if Babcock Industries used the departmental overhead rates to allocate manufacturing overhead?

Correct Answer:

Verified

_TB1765_00_TB1765_00...

_TB1765_00_TB1765_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: The departmental overhead cost allocation rate is

Q17: Dudley & Spahr,Attorneys at Law,provide a variety

Q23: Sparrow Manufacturing manufactures small parts and uses

Q30: ABC costing might lead to<br>A) cutting back

Q80: Which of the following statements does NOT

Q122: Plantwide overhead rates typically do a better

Q148: The storage of raw materials is considered

Q170: As a result of cost distortion, either

Q177: Sector's Machine Works manufactures custom equipment. Sector's

Q207: Merchandising and service companies, as well as