Multiple Choice

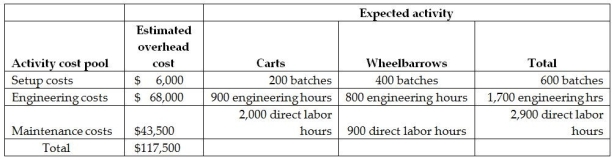

Vittoria Corporation manufactures two products-Carts and Wheelbarrows.The annual production and sales of Carts is 2,000 units,while 1,800 units of Wheelbarrows are produced and sold.The company has traditionally used direct labour hours to allocate its overhead to products.Carts require 1.0 direct labour hours per unit,while Wheelbarrows require 0.5 direct labour hours per unit.The total estimated overhead for the period is $117,500.The company is looking at the possibility of changing to an activity-based costing system for its products.If the company used an activity-based costing system,it would have the following three activity cost pools:

The predetermined overhead allocation rate using the traditional costing system would be closest to

A) $40.52 per direct labour hour.

B) $130.56 per direct labour hour.

C) $58.75 per direct labour hour.

D) $30.92 per direct labour hour.

Correct Answer:

Verified

Correct Answer:

Verified

Q44: Refined costing systems can be used to

Q46: Four basic steps are used in an

Q50: Hinckley & Granger Company had the following

Q51: Vittoria Corporation manufactures two products-Carts and Wheelbarrows.The

Q53: Traditions Home Accessories Company manufactures pillows using

Q54: Electronics Unlimited uses activity-based costing to allocate

Q64: Machine set-up would most likely be classified

Q102: One condition that favours using a plantwide

Q115: The cost allocation rate for each activity

Q216: Value-added activities are activities that could be