Multiple Choice

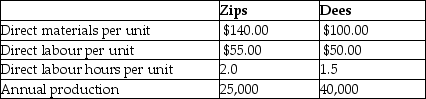

Kepple Manufacturing currently uses a traditional costing system.The company allocates overhead to its two products,Zips and Dees,using a predetermined manufacturing overhead rate based on direct labour hours.Here is data related to the company's two products:

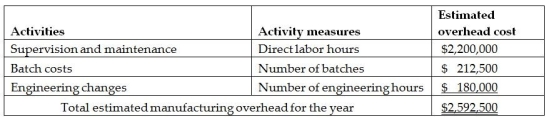

Information about the company's estimated manufacturing overhead for the year follows:

Total estimated direct labour hours for the company for the year are 110,000 hours.

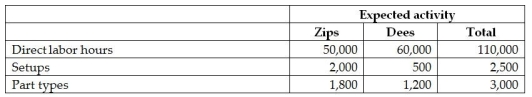

The company is evaluating whether it should use an activity-based costing system in place of its traditional costing system.Additional information about production needed for the activity-based costing system follows:

Note: engineering hours and part types are equivalent.

The amount of manufacturing overhead that would be allocated to one unit of Zips using an activity-based costing system would be closest to

A) $32.86.

B) $51.12.

C) $64.81.

D) $11.95.

Correct Answer:

Verified

Correct Answer:

Verified

Q63: Which of the following condition(s) favours using

Q75: Salcido,LLC provides a wide variety of legal

Q77: Rach & Johnson is an advertising agency.The

Q90: A departmental overhead rate is calculated by

Q115: The allocation base selected for each department

Q145: Value-added activities can be described as activities

Q150: Which of the following describes how, in

Q182: The benefits are lower when ABC reports

Q192: The benefits of adopting ABC/ABM are higher

Q221: Machine set-up would be considered a batch-level