Multiple Choice

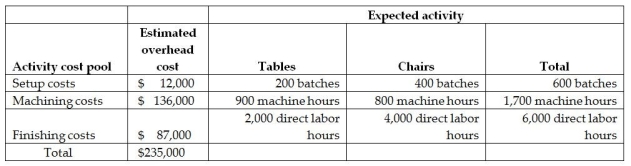

Menno Corporation manufactures two products-Tables and Chairs.The annual production and sales of Tables is 2,000 units,while 8,000 units of Chairs are produced and sold.The company has traditionally used direct labour hours to allocate its overhead to products.Tables require 1.0 direct labour hours per unit,while Chairs require 0.5 direct labour hours per unit.The total estimated overhead for the period is $235,000.The company is looking at the possibility of changing to an activity-based costing system for its products.If the company used an activity-based costing system,it would have the following three activity cost pools:

The predetermined overhead allocation rate using the traditional costing system would be closest to:

A) $43.50 per direct labour hour.

B) $21.75 per direct labour hour.

C) $39.17 per direct labour hour.

D) $14.50 per direct labour hour.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: To determine the amount of overhead allocated,

Q77: If a company's plantwide overhead rate is

Q99: In using an ABC system, which of

Q116: Sparrow Manufacturing manufactures small parts and uses

Q117: Louis Corporation,which uses an activity-based costing system,produces

Q119: Martin Corporation manufactures two products-Plows and Harrows.The

Q120: Credit Valley Products manufactures its products in

Q122: Sparrow Manufacturing manufactures small parts and uses

Q123: Rhapsody Corporation manufactures several different products and

Q129: Unit-level activities and costs are incurred once