Multiple Choice

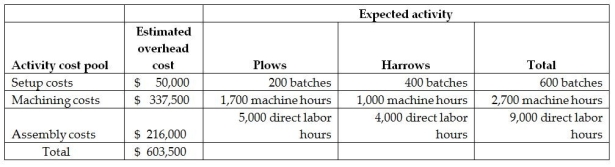

Martin Corporation manufactures two products-Plows and Harrows.The annual production and sales of Plows is 1,000 units,while 2,000 units of Harrows are produced and sold.The company has traditionally used direct labour hours to allocate its overhead to products.Plows require 5.0 direct labour hours per unit,while Harrows require 2.0 direct labour hours per unit.The total estimated overhead for the period is $603,500.The company is looking at the possibility of changing to an activity-based costing system for its products.If the company used an activity-based costing system,it would have the following three activity cost pools:

The cost pool activity rate for Machining Costs would be closest to

A) $223.52 per Machine hour.

B) $198.53 per Machine hour.

C) $125.00 per Machine hour.

D) $37.50 per Machine hour.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: The departmental overhead cost allocation rate is

Q23: Sparrow Manufacturing manufactures small parts and uses

Q30: ABC costing might lead to<br>A) cutting back

Q30: Moylan & Bolognese,Attorneys at Law,provide a variety

Q32: One condition that favours using departmental overhead

Q33: The cost of inspecting and packaging EACH

Q43: Signs that a product cost system is

Q80: Which of the following statements does NOT

Q107: The cost of depreciation, insurance, and property

Q170: As a result of cost distortion, either