Essay

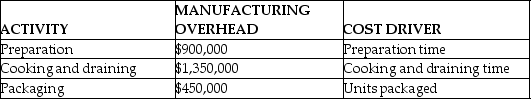

Clucker Chicken produces several styles of precooked and package chicken wings (drums,

tips,buffalo and coated with a variety of spices and sauces).Each style of wing requires different

preparation time,different cooking and draining times and different packaging.Therefore

the company management has decided to try ABC costing to better capture the manufacturing

overhead costs incurred by each style of wing.The following activities related to yearly

manufacturing overhead costs and cost drivers have been identified:

Compute the activity cost allocation rates for each activity assuming the following total estimated activity for the year: 45,000 hours preparation time,45,000 cooking and draining hours,and 9,000,000 packages.

Correct Answer:

Verified

Allocation bases:

Preparation = $900,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Preparation = $900,000...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Activity-based management refers to using activity-based cost

Q44: Activity-based costing considers _ to be the

Q96: Companies often refine their cost allocation systems

Q118: Using factory utilities would most likely be

Q129: Green Bags Company manufactures cloth grocery bags

Q130: Bond Industries uses departmental overhead rates to

Q131: Traditions Home Accessories Company manufactures pillows using

Q136: Pittinger Company manufactures cuckoo clocks and uses

Q137: Sparrow Manufacturing manufactures small parts and uses

Q139: Franklin Corporation manufactures a wide variety of