Essay

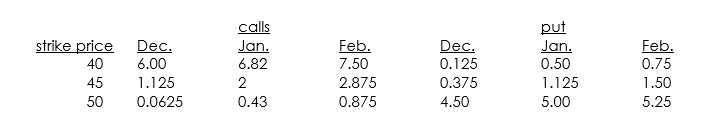

The following is a listing of option prices on Perdida Enterprises on December 12,2002:

The current stock price is 45.75,and the riskless rate is 7%.

a. Consider the following position: sell one January 40 call; buy two January 45 calls; sell one January 50 call. Evaluate the net cash flows on this position at expiration for different stock prices, and draw a payoff diagram.

b. Are the three January put options correctly priced relative to the corresponding call options? (Assume that there are 42 days on the January option.)

Correct Answer:

Verified

a.

Net premium form the positions would ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Net premium form the positions would ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: Merle Linch,an up-and-coming security analyst has found

Q102: On January 1,1991,you are considering buying stock

Q103: You are evaluating the riskiness of a

Q104: You are an analyst looking at the

Q105: Which of the following is an implication

Q107: Which of the following statements is true

Q108: Stocks that have high P/E ratios are

Q109: The fact that superior returns can not

Q110: The only significant cost of storing gold

Q111: Which of the following statements is true?<br>A)