Essay

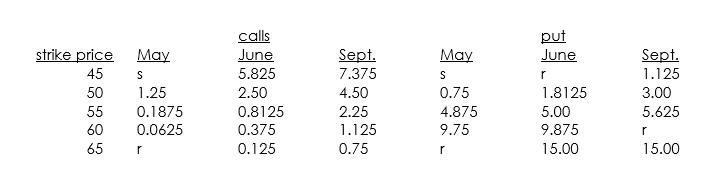

You have just learned through the grapevine that Pfizer (currently at $50.625 per share)may be a takeover candidate at $65 per share.You would like to speculate on the rumor,but you are worried that the stock will drop significantly if the rumor is false.Therefore,you have decided to use options to exploit this information.You are given the following option data for today,May 15th:

calls puts

a. Set up an option position that will best exploit the information you have, assuming that the takeover will happen by September 16 (the expiration day of the September options).

b. Assume now that the annualized standard deviation of Pfizer's stock price is 0.40 and that the six-month T-bill rate is 6%. Furthermore, assume that Pfizer pays a quarterly dividend of 50 cents and that the dividends are paid in April, July, October and January. What would your Black-Scholes estimates be for the options in the position that you have described in part a?

c. If the beta of Pfizer stock is 1.0, what is the beta of the position that you have set up in part a?

d. What are the deltas of the options that you have chosen for your position?

Correct Answer:

Verified

a.

The investor wants to participate on ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The investor wants to participate on ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q37: You can form a portfolio from the

Q38: A $1,000 par bond has an annual

Q39: Discuss whether the following statement is true

Q40: Your friend claims that,since the market went

Q41: Discuss whether the following statement is true

Q43: It is now time 0.You are a

Q44: Consider the purchase of a put option

Q45: You have just completed a study

Q46: Herbert Avocado has just come up with

Q47: What is the phenomenon of the size