Essay

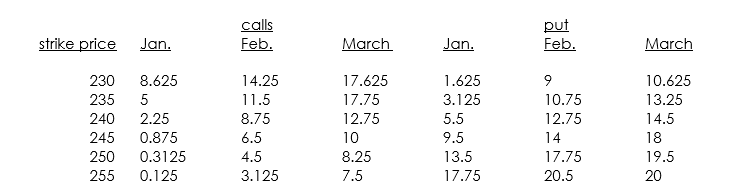

The trade deficit numbers are expected out on February 19,and you think that market will move a lot,either up or down.You want to take advantage of this using options.You are given the following stock-index option data for today,January 14 (the current level of the index is 236.99,and the annualized T-bill rate is 6%):

a. Find at least two options in the above listing that violate arbitrage

conditions.

b. How would you set up a position using February options to take advantage

of the volatility from the trade deficit numbers? (The February options expire

on the evening of February 19.)

c. What are the breakeven points for the position in part b? (You can draw a

payoff diagram if you want to.)

d. Assume no dividends are paid and that the variance in the stock index is

0.09, and use the Black-Scholes model to value the February 235 call and

the February 235 put.

Correct Answer:

Verified

Time to expiration for the February cont...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q54: You have been asked to determine the

Q55: Discuss whether the following statement is true

Q56: In November 1978,the Fed announced a stringent

Q57: Discuss whether the following statement is true

Q58: Consider the following securities: a fully taxable

Q60: Which of the following is not a

Q61: Which of the following investment strategies is

Q62: a. Would a 10-year, 15% U.S. Treasury

Q63: Assume you want to get a 5-year

Q64: What is an "event study"? Discuss a