Essay

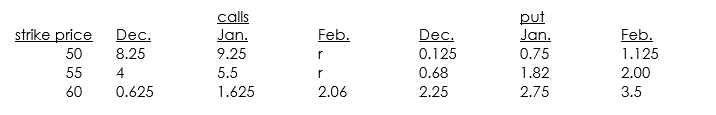

You are interested in putting together an option position on Flaming Yon,Inc.The current stock price is 58.25,and The Wall Street Journal of December 11,2002,reports the following prices for the various listed options on the stock:

a. Assume that you buy a January 50 call and a January 60 put. Draw the payoff diagram for this position at maturity.

b. What are the upside and downside breakeven points for this position?

Correct Answer:

Verified

a.

The payoff from long positions on bo...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The payoff from long positions on bo...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q93: Assume that it is now December 2002.You

Q94: Consider a forecast of the next period's

Q95: You have been asked to estimate the

Q96: You want to invest $1 million in

Q97: In a strongly efficient market,no mutual fund

Q99: You are the CFO of a small

Q100: Discuss whether the following statement is true

Q101: Merle Linch,an up-and-coming security analyst has found

Q102: On January 1,1991,you are considering buying stock

Q103: You are evaluating the riskiness of a