Essay

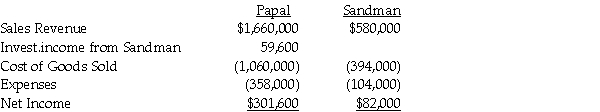

Papal Corporation acquired an 80% interest in Sandman Corporation at a cost equal to 80% of the book value of Sandman's net assets in 2013.At the time of the acquisition,the book values and fair values of Sandman's assets and liabilities were equal.During 2014,Papal recorded sales of $440,000 of merchandise to Sandman at a gross profit rate of 30%.Sandman's beginning and ending inventories for 2014 were $60,000 and $80,000,respectively.Income statement information for both companies for 2014 is as follows:

Required:

Prepare a consolidated income statement for Papal Corporation and Subsidiary for 2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Pexo Industries purchases the majority of their

Q3: Phast Corporation owns a 80% interest in

Q4: Use the following information to answer the

Q18: Plateau Incorporated bought 60% of the common

Q19: Use the following information to answer the

Q24: A(n)_ sale is a sale by a

Q25: Assume there are routine inventory sales between

Q27: Use the following information to answer the

Q31: Use the following information to answer the

Q35: On January 1,2014,Palling Corporation purchased 70% of