Essay

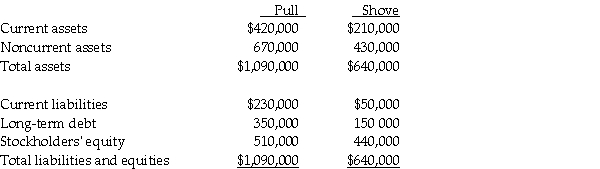

Pull Incorporated and Shove Company reported summarized balance sheets as shown below,on December 31,2014.

On January 1,2015,Pull purchased 70% of the outstanding capital stock of Shove for $392,000,of which $92,000 was paid in cash,and $300,000 was borrowed from their bank.The debt is to be repaid in 10 annual installments beginning on December 31,2015,with each payment consisting of $30,000 principal,plus accrued interest.

The excess fair value of Shove Company over the underlying book value is allocated to inventory (60 percent)and to goodwill (40 percent).

Required: Calculate the balance in each of the following accounts,on the consolidated balance sheet,immediately following the acquisition.

a.Current assets

b.Noncurrent assets

c.Current liabilities

d.Long-term debt

e.Stockholders' equity

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Pawl Corporation acquired 90% of Snab Corporation

Q2: Pecan Incorporated acquired 80% of the voting

Q5: Pigeon Corporation acquired an 80% interest in

Q5: Use the following information to answer question(s)

Q6: On consolidated working papers,a subsidiary's net income

Q8: Parrot Corporation acquired 90% of Swallow Co.on

Q9: On December 31,2014,Paladium International purchased 70% of

Q11: On January 2,2014,Paleon Packaging purchased 90% of

Q16: In contrast with single entity organizations,consolidated financial

Q38: When preparing the consolidation workpaper for a