Essay

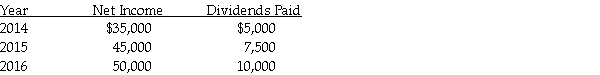

On January 1,2014,Persona Company acquired 80% of Sule Tooling for $332,000.At that time,Sule reported their Common stock at $150,000,Additional paid in capital at $45,000,and Retained earnings at $105,000.Sule also had equipment on their books that had a remaining life of 10 years and were undervalued on the books by $40,000,but any additional fair value/book value differential is assumed to be goodwill.During the next three years,Sule reported the following:

Required: Calculate the following.

a.How much excess depreciation or amortization would be recognized in the consolidated financial statements in each of these three years?

b.How much goodwill would be recognized on the balance sheet at the date of acquisition,and at the end of each year listed?

c.How much investment income would be reported by Persona under the equity method for each of the three years?

d.What would be the balance in the Investment in Sule account at January 1,2014,and at the end of each of the three years listed?

Correct Answer:

Verified

a.Excess depreciation = Excess fair va...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

a.Excess depreciation = Excess fair va...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Use the following information to answer question(s)

Q9: Use the following information to answer question(s)

Q12: Packo Company acquired all the voting stock

Q13: Flagship Company has the following information collected

Q18: Puddle Corporation acquired all the voting stock

Q21: On January 1,2014,Paisley Incorporated paid $300,000 for

Q22: Bird Corporation has several subsidiaries that are

Q25: Use the following information to answer question(s)

Q42: A parent company uses the equity method

Q44: Which one of the following will increase