Essay

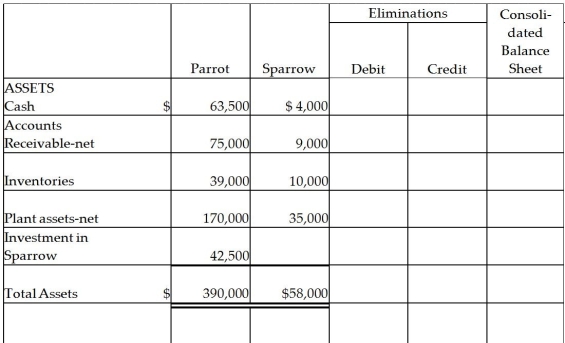

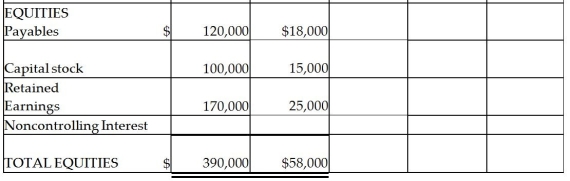

Parrot Inc.acquired an 85% interest in Sparrow Corporation on January 2,2014 for $42,500 cash when Sparrow had Capital Stock of $15,000 and Retained Earnings of $25,000.Sparrow's assets and liabilities had book values equal to their fair values except for inventory that was undervalued by $2,000.Balance sheets for Parrot and Sparrow on January 2,2014,immediately after the business combination,are presented in the first two columns of the consolidated balance sheet working papers.

Required:

Complete the consolidation balance sheet working papers for Parrot and subsidiary at January 1,2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: In the consolidated income statement of Wattlebird

Q16: On January 1,2014,Myna Corporation issued 10,000 shares

Q17: On July 1,2014,Piper Corporation issued 23,000 shares

Q18: Park Corporation paid $180,000 for a 75%

Q20: On January 2,2014,Power Incorporated paid $630,000 for

Q23: Pamula Corporation paid $279,000 for 90% of

Q25: Passerby International purchased 80% of Standaround Company's

Q39: Pomograte Corporation bought 75% of Sycamore Company's

Q45: Subsequent to an acquisition,the parent company and

Q48: On June 1,2014,Puell Company acquired 100% of