Multiple Choice

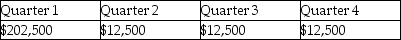

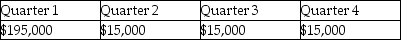

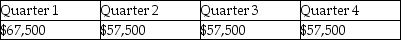

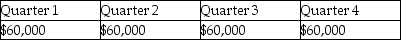

On January 5,2014,Eagle Corporation paid $50,000 in real estate taxes for the calendar year.In March of 2014,Eagle paid $180,000 for an annual machinery overhaul and $10,000 for the annual CPA audit fee.What amount was expensed for these items on Eagle's quarterly interim financial statements?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Which of the following is not a

Q10: How does GAAP view interim accounting periods?<br>A)As

Q11: Krull Corporation is preparing its interim financial

Q15: The following data relate to Elle Corporation's

Q16: GAAP requires disclosures for each reportable operating

Q16: Snodberry Catering has five operating segments,as summarized

Q19: In general,GAAP encourages the identification of reportable

Q22: Illiana Corporation has several accounting issues with

Q40: Similar operating segments may be combined if

Q44: Dott Corporation experienced a $100,000 extraordinary loss