Essay

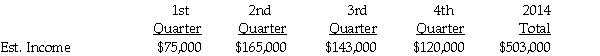

Nettle Corporation is preparing its first quarterly interim report.It is subject to a corporate income tax rate of 20% on the first $50,000 of taxable income and 35% on taxable income above $50,000.Its estimated pretax accounting income for 2014,by quarter,is:

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Required:

1.Determine Nettle's estimated effective tax rate for 2014.

2.Prepare a schedule to show Nettle's estimated net income for each quarter of 2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Which of the following is not a

Q10: How does GAAP view interim accounting periods?<br>A)As

Q15: The following data relate to Elle Corporation's

Q16: Snodberry Catering has five operating segments,as summarized

Q17: What is the threshold for reporting a

Q19: In general,GAAP encourages the identification of reportable

Q20: The accountant for Baxter Corporation has assigned

Q23: For internal decision-making purposes,Elom Corporation's operating segments

Q24: The following information was collected together for

Q25: GAAP requires that segment information be reported<br>A)by