Essay

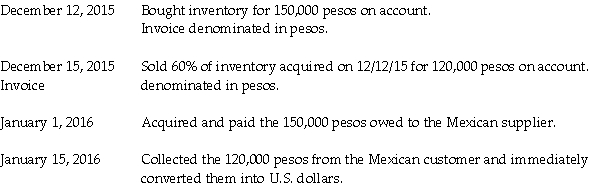

Johnson Corporation (a U.S.company)began operations on December 1,2014,when the owner contributed $100,000 of his own money to establish the business.Johnson then had the following import and export transactions with unaffiliated Mexican companies:

The following exchange rates apply:

Required:

1.What were Sales in the income statement for the year ended December 31,2015?

2.What was the COGS associated with these sales?

3.What is the Accounts Payable balance in the balance sheet at December 31,2015?

4.What is the Inventory balance in the balance sheet at December 31,2015?

Correct Answer:

Verified

1.Sales = December 15 sale of 120,000 pe...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Use the following information to answer the

Q20: A direct quote for the U.S.dollar is

Q24: A U.S.importer that purchased merchandise from a

Q26: On May 1,2014,Deerfield Corporation purchased merchandise from

Q29: Ulysses Company purchases goods from China amounting

Q30: Crabby Industries,a U.S.corporation,purchased inventory from a company

Q31: Lincoln Corporation,a U.S.manufacturer,both imports needed materials and

Q32: Piel Corporation (a U.S.company)began operations on January

Q36: Tank Corporation,a U.S.manufacturer,has a June 30 fiscal

Q44: When the billing for a U.S.company's sale