Essay

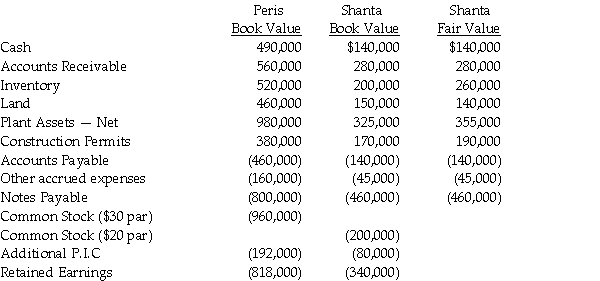

On December 31,2013,Peris Company acquired Shanta Company's outstanding stock by paying $400,000 cash and issuing 10,000 shares of its own $30 par value common stock,when the market price was $32 per share.Peris paid legal and accounting fees amounting to $35,000 in addition to stock issuance costs of $8,000.Shanta is dissolved on the date of the acquisition.Balance sheet information for Peris and Shanta immediately preceding the acquisition is shown below,including fair values for Shanta's assets and liabilities.

Required: Determine the consolidated balances which Peris would present on their consolidated balance sheet for the following accounts.

Cash

Inventory

Construction Permits

Goodwill

Notes Payable

Common Stock

Additional Paid in Capital

Retained Earnings

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Picasso Co.issued 5,000 shares of its $1

Q4: Bigga Corporation purchased the net assets of

Q5: Saveed Corporation purchased the net assets of

Q6: In reference to international accounting for goodwill,U.S.companies

Q7: On January 2,2013 Piron Corporation issued 100,000

Q10: On January 2,2013,Pilates Inc.paid $900,000 for all

Q28: Which of the following is not a

Q30: Pitch Co.paid $50,000 in fees to its

Q34: Use the following information to answer

Q36: Pepper Company paid $2,500,000 for the net