Essay

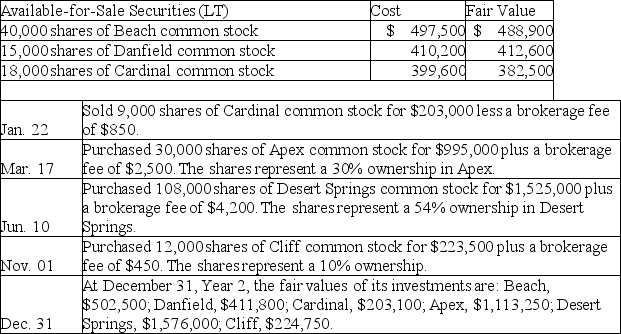

Weston Company had the following long-term available-for-sale securities in its portfolio at December 31,Year 1.Weston had several long-term investment transactions during the next year.After analyzing the effects of each transaction, (1)determine the amount Weston should report on its December 31,Year 1 balance sheet for its long-term investments in available-for-sale securities, (2)determine the amount Weston should report on its December 31,Year 2 balance sheet for its long-term investments in available-for-sale securities, (3)prepare the necessary adjusting entry to record the fair value adjustment at December 31,Year 2.

Correct Answer:

Verified

\[\begin{array} { | l | r | l | }

\hlin...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

\hlin...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Match the following terms with the appropriate

Q46: What is comprehensive income and how is

Q58: Investments can be classified as all but

Q75: Foreign exchange rates fluctuate due to changes

Q82: On January 3, Kostansas Corporation purchased 5,000

Q101: A company has net income of $250,000,

Q115: Held-to-maturity securities are:<br>A)Always classified as Short-Term Investments.<br>B)Always

Q160: Zhang Corp.owns 40% of Magnor Company's common

Q189: Debt securities are recorded at cost when

Q190: What are the accounting basics for debt