Essay

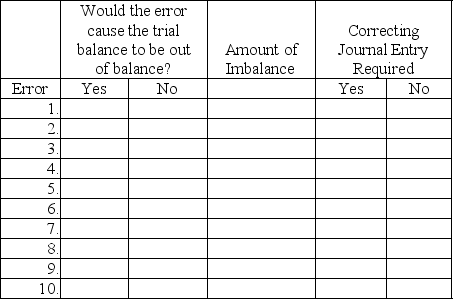

At year-end,Henry Laundry Service noted the following errors in its trial balance:

1.It understated the total debits to the Cash account by $500 when computing the account balance.

2.A credit sale for $311 was recorded as a credit to the revenue account,but the offsetting debit was not posted.

3.A cash payment to a creditor for $2,600 was never recorded.

4.The $680 balance of the Prepaid Insurance account was listed in the credit column of the trial balance.

5.A $24,900 van purchase was recorded as a $24,090 debit to Equipment and a $24,090 credit to Notes Payable.

6.A purchase of office supplies for $150 was recorded as a debit to Office Equipment.The offsetting credit entry was correct.

7.An additional investment of $4,000 by the stockholder was recorded as a debit to Common Stock and as a credit to Cash.

8.The cash payment of the $510 utility bill for December was recorded (but not paid)twice.

9.The revenue account balance of $79,817 was listed on the trial balance as $97,817.

10.A $1,000 cash dividend was recorded as a $100 debit to Dividends and $100 credit to Cash.

143.

Using the form below,indicate whether each error would cause the trial balance to be out of balance,the amount of any imbalance,and whether a correcting journal entry is required.

Correct Answer:

Verified

Correct Answer:

Verified

Q48: Mary Martin,the sole stockholder of Martin

Q50: Mary Sunny began business as Sunny Law

Q53: Match the following terms with the appropriate

Q54: HH Consulting & Design provided $800

Q107: The debt ratio is calculated by dividing

Q109: An income statement is also called an

Q121: Revenues always increase equity.

Q161: An account's balance is the difference between

Q169: At the beginning of January of the

Q186: Explain the difference between a general ledger