Multiple Choice

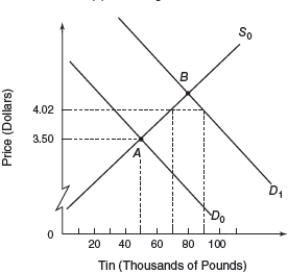

Figure 7.4 Global Market for Tin

-Consider the global market for tin represented by figure 7.4.Initially equilibrium is at point A with a market price of $3.50 per pound and 50,000 pounds.In ordr to keep tin price relatively stable an International Tin Agreement has set a price floor of $3.27 and a ceiling of $4.02.As the demand for tin increases to D1 how will the buffer-stock manager need to respond?

A) buy 10,000 pounds of tin

B) buy 20,000 pounds of tin

C) sell 10,000 pounds of tin

D) sell 20,000 pounds of tin

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The developing nations are most of those

Q17: Figure 7.3. World Oil Market <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7110/.jpg"

Q22: Empirical research indicates that the demand and

Q27: The purpose of a cartel is to

Q34: All of the following nations except _

Q42: Under the Generalized System of Preferences program,

Q57: The "newly industrializing countries" of East Asia

Q130: Which trade strategy have developing countries used

Q171: The diagram below illustrates the international tin

Q292: Stabilizing commodity prices around long-term trends tends