Multiple Choice

Which of the following entries would be recorded if a company uses the cash basis method of accounting?

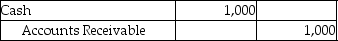

A)

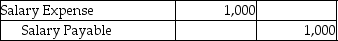

B)

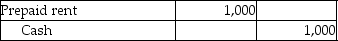

C)

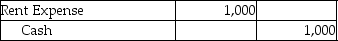

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q15: To match expenses against revenues means to

Q24: Which of the following accounts does cash

Q44: Ursula Tax Planning Service has the following

Q52: The accountant for Noble Jewelry Repair Services

Q53: Kostner Financial Services Inc.performed accounting services for

Q72: In the case of unearned revenue, the

Q104: The sum of all the depreciation expense

Q111: All of a company's accounts and their

Q112: The Accumulated Depreciation account is _.<br>A)a record

Q131: What type of account is Prepaid Rent,and