Multiple Choice

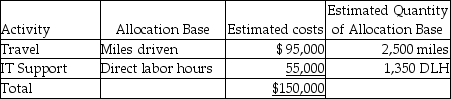

Dunby Inc.,a law consulting firm,has been using a single plantwide rate with direct labor hours as the allocation base to allocate overhead costs.The direct labor rate is $250 per hour.Chandler Massey,the president of Dunby,decided to develop an ABC system to accurately allocate the indirect costs.He identified two activities that amount to the total indirect costs- travel and information technology support.The other relevant details are given below:  During the current month,Dunby's consultants spent 175 labor hours for Xyme Inc.The job required the professionals to travel 30 miles in total.Determine the total cost of the consulting job using the ABC system.

During the current month,Dunby's consultants spent 175 labor hours for Xyme Inc.The job required the professionals to travel 30 miles in total.Determine the total cost of the consulting job using the ABC system.

A) $43,750

B) $8,270

C) $7,130

D) $52,020

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Under the just-in-time management system,_.<br>A)a company's storage

Q28: The _ system attracts materials,labor,and overhead into

Q32: Adriano Corp.sold 2,500 cell phones on account

Q33: Cilia Corp.specializes in the production of finials

Q52: Which of the following statements is true

Q53: Target cost is calculated by deducting desired

Q166: Which of the following statements is true

Q170: Which of the following is a nonmanufacturing

Q231: Which of the following would most likely

Q248: Direct material costs and direct labor costs