Essay

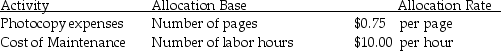

Vincent Jardine,a CPA,has a firm in the state of New York.Vincent uses ABC to allocate overhead costs and has computed the following predetermined overhead allocation rates:

Vincent has important contacts in the northeastern parts of New York.During the past month,Vincent completed a job for Nurix Inc.The job required 135 labor hours and 4,000 photocopies.Determine the amount of indirect costs to be allocated to the job.

Vincent has important contacts in the northeastern parts of New York.During the past month,Vincent completed a job for Nurix Inc.The job required 135 labor hours and 4,000 photocopies.Determine the amount of indirect costs to be allocated to the job.

Correct Answer:

Verified

Correct Answer:

Verified

Q95: Pitt Jones Company,a manufacturer of small appliances,had

Q96: Alpha Company manufactures breadboxes and uses an

Q97: Predetermined overhead allocation rate is an estimated

Q99: Pitt Jones Company,a manufacturer of small appliances,had

Q100: Just-in-time management systems use a combined account

Q102: The steps of an activity-based costing for

Q103: Internal failure costs are costs incurred _.<br>A)to

Q114: Target pricing starts with the full product

Q146: _ are costs incurred after the company

Q147: A company is most likely to use