Essay

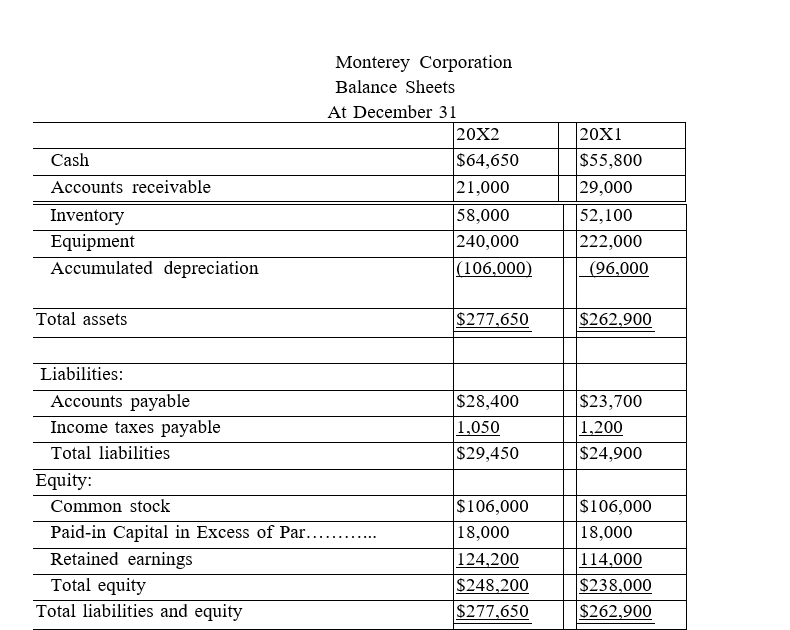

Based on the information in the following income statement and balance sheet for Monterey Corporation, determine the cash flows from operating activities using the direct method.

Monterey Corporation Income Statement

For Year Ended December 31, 20X2

Correct Answer:

Verified

None...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q163: Which of the following is included in

Q164: All of the following statements related to

Q165: Use the following income statement and

Q166: The primary purpose of the statement of

Q167: Based on the following income statement

Q169: A purchase of land in exchange for

Q170: The statement of cash flows cannot help

Q171: Stormer Company reports the following amounts on

Q172: A company reported that its bonds with

Q173: The cash flow on total assets ratio