Essay

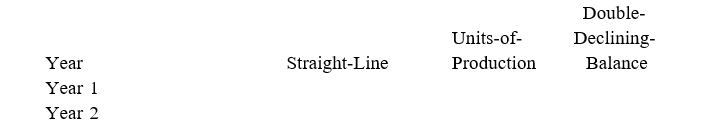

A machine costing $450,000 with a 4-year life and an estimated salvage value of $30,000 is installed by Peters Company on January 1. The company estimates the machine will produce 1,050,000 units of product during its life. It actually produces the following units for the first 2 years: Year 1, 260,000; Year 2, 275,000. Enter the depreciation amounts for years 1 and 2 in the table below for each depreciation method. Show calculation of amounts below the table.

Correct Answer:

Verified

Straight-line:  -

-  for each ...

for each ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Straight-line:

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q184: Obsolescence refers to the insufficient capacity of

Q185: Gaston owns equipment that cost $90,500 with

Q186: Another name for a capital expenditure is:<br>A)

Q187: One characteristic of plant assets is that

Q188: The units-of-production method of depreciation charges a

Q190: Depreciation does not measure the decline in

Q191: The purchase of a property that included

Q192: Mohr Company purchases a machine at the

Q193: Edmond reported average total assets of $9,965

Q194: Suarez Company uses the straight-line method of