The Following Adjusted Trial Balance Is for Carla Co Required: Prepare a Classified Balance Sheet as of December 31

Essay

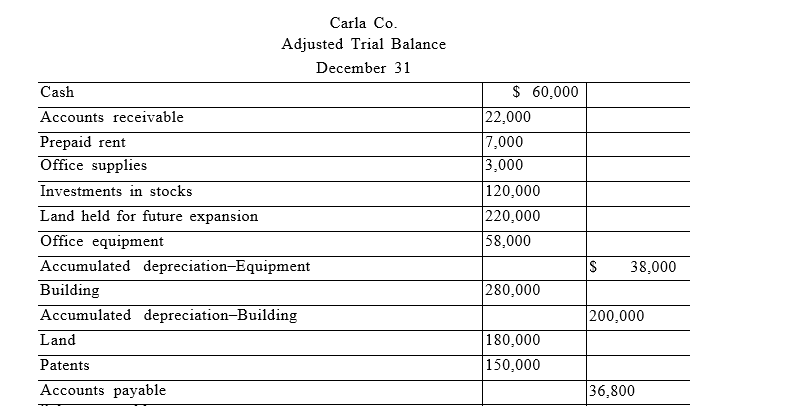

The following adjusted trial balance is for Carla Co. at year-end December 31. The credit balance in Carla West, Capital at the beginning of the year, January 1, was $320,000. The owner, Carla West, invested an additional $100,000 during the current year. The land held for future expansion was also purchased during the current year.

Required: Prepare a classified balance sheet as of December 31. (Note: A $21,000 installment on the long-term note payable is due within one year.)

Correct Answer:

Verified

None...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: After preparing and posting the closing entries

Q4: The following information is available for

Q5: Tara Westmont, the proprietor of Tiptoe Shoes,

Q6: Current liabilities include accounts receivable, unearned revenues,

Q7: Closing the temporary accounts at the end

Q9: Two common subgroups for liabilities on a

Q10: Reversing entries are recorded in response to

Q11: The following information is available for

Q12: The Income Summary account is used to:<br>A)

Q13: All necessary amounts needed to prepare the