Essay

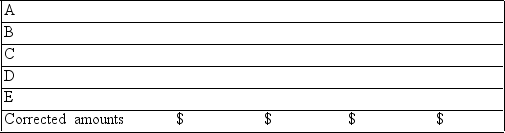

A company issued financial statements for the year ended December 31, but failed to include the following adjusting entries:

A. Accrued interest revenue earned of $1,200.

B. Depreciation expense of $4,000.

C. Portion of prepaid insurance expired (an asset) used $1,100.

D. Accrued taxes of $3,200.

E. Revenues of $5,200, originally recorded as unearned, have been earned by the end of the year. Determine the correct amounts for the December 31 financial statements by completing the following table:

Correct Answer:

Verified

\[\begin{array} { | l c c c c | }

\hlin...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

\hlin...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: A company records the fees for legal

Q7: An account linked with another account that

Q8: On April 1, Santa Fe, Inc. paid

Q9: Prior to recording adjusting entries on December

Q10: Interim financial statements report a company's business

Q12: In its first year of operations, Grace

Q13: Accrual accounting and the adjusting process rely

Q14: An adjusting entry was made on

Q15: A company purchased new furniture at a

Q16: If accrued salaries were recorded on December