Multiple Choice

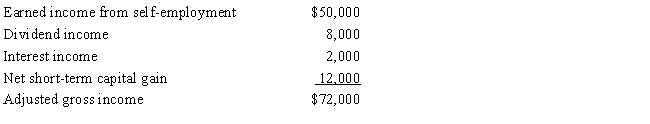

Susan is a self-employed accountant with a qualified defined contribution plan (a Keogh plan) . She has the following income items for the year:  What is the maximum amount Susan can deduct as a contribution to her retirement plan in 2017, assuming the self-employment tax rate is 15.3%?

What is the maximum amount Susan can deduct as a contribution to her retirement plan in 2017, assuming the self-employment tax rate is 15.3%?

A) $9,235.

B) $12,000.

C) $46,000.

D) $46,468.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: A direct transfer of funds from a

Q82: In a direct transfer from one qualified

Q92: If an employer's contribution to a SEP

Q93: Deidre has five years of service completed

Q94: Fred is a self-employed accountant with gross

Q94: A taxpayer who receives a distribution can

Q95: A defined benefit plan must reduce the

Q96: Which of the followings is not a

Q100: Which of the following characteristics is not

Q101: Sammy, age 31, is unmarried and is