Essay

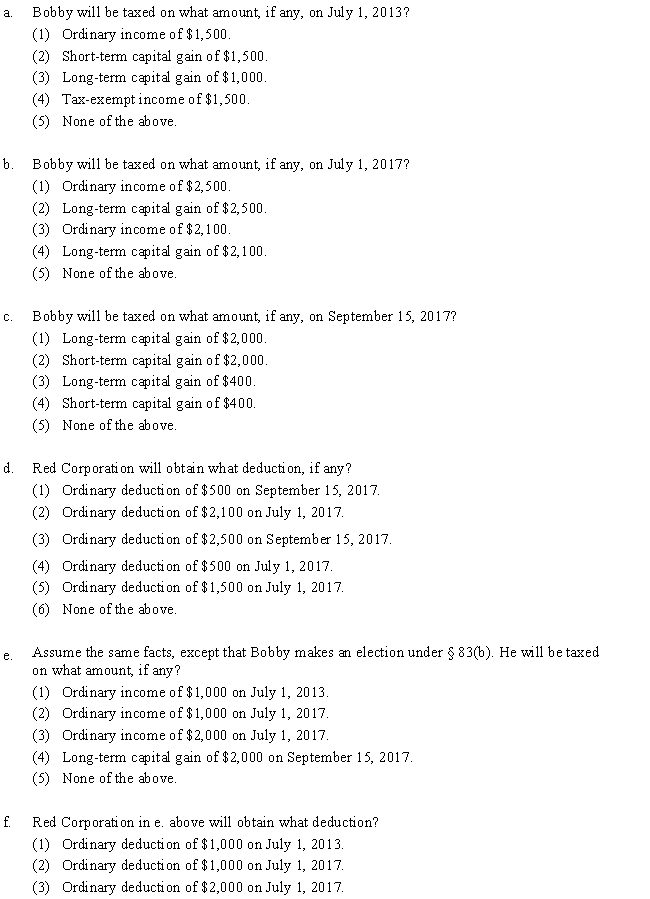

On July 1, 2013, Red Corporation sold 100 of its common shares (worth $15 per share) to its employee Bobby for $5 per share. The sale was subject to Bobby's agreement to resell the shares to the corporation for $5 per share if his employment is terminated within the following four years. The shares were valued at $26 per share on July 1, 2017. He sold the shares for $30 per share on September 15, 2017. No special election under § 83(b) was made. Identify the correct answer.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: A company is denied a deduction for

Q37: Determine the nonforfeiture percentage under these independent

Q41: After 2011, income averaging is allowed for

Q42: What is a profit sharing plan?

Q43: Chee is a key employee of an

Q44: A participant, who is age 38, in

Q45: The special § 83(b) election (i.e., where

Q47: If a married taxpayer is an active

Q76: Saysha is an officer of a local

Q87: The minimum annual distributions must be made