Essay

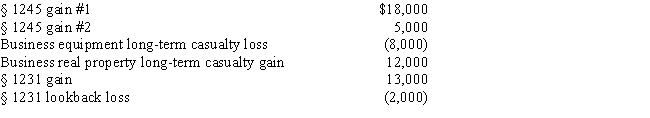

Betty, a single taxpayer with no dependents, has the gains and losses shown below. Before considering these transactions, Betty has $45,000 of other taxable income. What is the treatment of the gains and losses and what is Betty's taxable income?

Correct Answer:

Verified

The § 1245 recapture gains are combined ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Which of the following would extinguish the

Q14: Red Company had an involuntary conversion on

Q18: A personal use property casualty loss is

Q24: Rental use depreciable machinery held more than

Q27: Section 1231 property generally does not include

Q32: The Code contains two major depreciation recapture

Q36: If there is a net § 1231

Q41: Personal use property casualty gains and losses

Q42: Involuntary conversion gains may be deferred if

Q63: Section 1245 applies to amortizable § 197