Essay

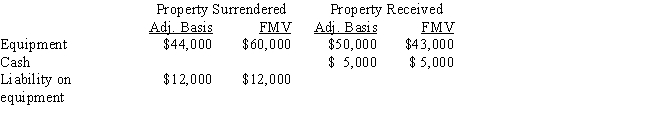

Sammy exchanges equipment used in his business in a like-kind exchange. The property exchanged is as follows:

The other party assumes the liability.

a.What is Sammy's recognized gain or loss?

b.What is Sammy's basis for the assets he received?

Correct Answer:

Verified

The recognized gain is ...

The recognized gain is ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q91: Melvin receives stock as a gift from

Q120: Beth sells investment land (adjusted basis of

Q121: An office building with an adjusted basis

Q123: Which of the following is incorrect?<br>A) The

Q124: Jake exchanges an airplane used in his

Q126: Which of the following statements is correct

Q127: During 2017, Howard and Mabel, a married

Q197: What kinds of property do not qualify

Q211: Abby exchanges an SUV that she has

Q216: For each of the following involuntary conversions,