Essay

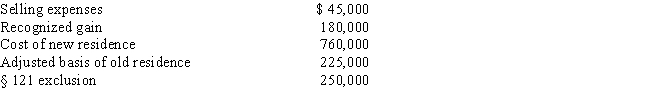

Use the following data to determine the sales price of Etta's principal residence and the realized gain. She is not married. The sale of the old residence qualifies for the § 121 exclusion.

Correct Answer:

Verified

The sale of residence model can be used ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: A building located in Virginia (used in

Q30: On October 1, Paula exchanged an apartment

Q52: In a nontaxable exchange, recognition is postponed.In

Q58: Owen and Polly have been married for

Q60: Evelyn's office building is destroyed by fire

Q64: Dennis, a calendar year taxpayer, owns a

Q65: During 2017, Zeke and Alice, a married

Q79: A taxpayer who sells his or her

Q102: Lenny and Beverly have been married and

Q176: Carl sells his principal residence, which has