Multiple Choice

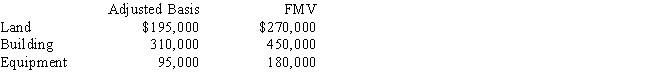

Mona purchased a business from Judah for $1,000,000. Judah's records and an appraiser provided her with the following information regarding the assets purchased:  What is Mona's adjusted basis for the land, building, and equipment?

What is Mona's adjusted basis for the land, building, and equipment?

A) Land $270,000, building $450,000, equipment $180,000.

B) Land $195,000, building $575,000, equipment $230,000.

C) Land $195,000, building $310,000, equipment $95,000.

D) Land $270,000, building $521,429, equipment $208,571.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Transactions between related parties that result in

Q45: If the fair market value of the

Q51: Purchased goodwill is assigned a basis equal

Q54: Ken is considering two options for selling

Q93: The holding period for nontaxable stock dividends

Q100: The basis for depreciation on depreciable gift

Q104: Ralph gives his daughter, Angela, stock (basis

Q140: Ed and Cheryl have been married for

Q141: If the alternate valuation date is elected

Q146: Kelly inherits land which had a basis