Essay

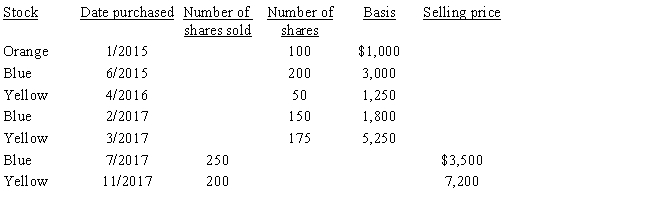

Omar has the following stock transactions during 2017:

a.What is Omar's recognized gain or loss on the stock sales if his objective is to minimize the recognized gain and to maximize the recognized loss?

b.What is Omar's recognized gain or loss if he does not identify the shares sold?

Correct Answer:

Verified

Sale of Blue stock

Sale of Blue stock

S...

S...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Kevin purchased 5,000 shares of Purple Corporation

Q32: Which of the following statements is false?<br>A)

Q48: Karen owns City of Richmond bonds with

Q70: The holding period for property acquired by

Q73: Why is it generally undesirable to pass

Q110: If a taxpayer purchases a business and

Q131: Noelle received dining room furniture as a

Q180: When a property transaction occurs, what four

Q213: Katie sells her personal use automobile for

Q221: Joyce's office building was destroyed in a