Essay

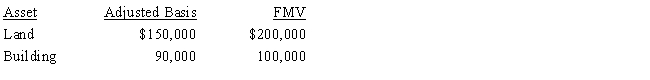

On September 18, 2017, Jerry received land and a building from Ted as a gift. Ted had purchased the land and building on March 5, 2014, and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid no gift tax on the transfer to Jerry.

a.Determine Jerry's adjusted basis and holding period for the land and building.

b.Assume instead that the FMV of the land was $89,000 and the FMV of the building was $60,000. Determine Jerry's adjusted basis and holding period for the land and building.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Broker's commissions, legal fees, and points paid

Q23: If losses are disallowed in a related-party

Q24: Marilyn owns 100% of the stock of

Q27: Discuss the application of holding period rules

Q30: If a husband inherits his deceased wife's

Q57: Lump-sum purchases of land and a building

Q98: The basis of inherited property usually is

Q128: Faith inherits an undivided interest in a

Q188: Gene purchased an SUV for $45,000 which

Q252: The taxpayer owns stock with an adjusted