Essay

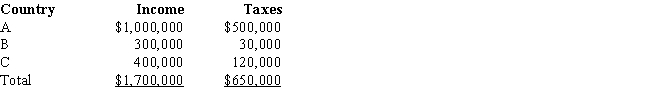

Summer Corporation's business is international in scope and is subject to income taxes in several countries. Summer's earnings and income taxes paid in the relevant foreign countries are:

If Summer Corporation's worldwide income subject to taxation in the United States is $2,400,000 and the U.S. income tax due prior to the foreign tax credit is $816,000, compute the allowable foreign tax credit. If, instead, the total foreign income taxes paid were $550,000, compute the allowable foreign tax credit.

If Summer Corporation's worldwide income subject to taxation in the United States is $2,400,000 and the U.S. income tax due prior to the foreign tax credit is $816,000, compute the allowable foreign tax credit. If, instead, the total foreign income taxes paid were $550,000, compute the allowable foreign tax credit.

Correct Answer:

Verified

Therefore, because the overall...

Therefore, because the overall...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Child care payments to a relative are

Q30: Dabney and Nancy are married, both gainfully

Q89: During the current year, Eleanor earns $120,000

Q99: The child tax credit is based on

Q104: Molly has generated general business credits over

Q105: Realizing that providing for a comfortable retirement

Q106: Roger is considering making a $6,000 investment

Q106: Several years ago, Sarah purchased a structure

Q110: Rick spends $750,000 to build a qualified

Q113: Phil and Audrey, husband and wife, both