Multiple Choice

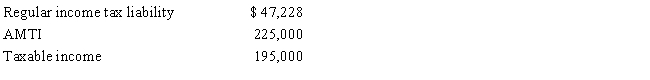

Ashby, who is single and age 30, provides you with the following information from his financial records for 2017.  Calculate his AMT exemption for 2017.

Calculate his AMT exemption for 2017.

A) $0

B) $26,075

C) $28,225

D) $54,300

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: Interest income on private activity bonds issued

Q8: On February 1, 2017, Omar acquires used

Q9: Which of the following statements regarding differences

Q10: Which of the following statements is correct?<br>A)

Q11: Which of the following statements describing the

Q14: The required adjustment for AMT purposes for

Q20: The recognized gain for regular income tax

Q22: In the current tax year for regular

Q53: Because passive losses are not deductible in

Q98: What itemized deductions are allowed for both